A2P SMS data and insight

No other A2P SMS market intelligence subscription delivers more!

Get a full view of global A2P SMS messaging market traffic and spend to 2030, from the global #1 business messaging intelligence specialists.

This is the only intelligence service to include quarterly datasets and report updates, essential to help your business respond to the ever-changing SMS market conditions in both domestic and international marketplaces.

You get:

- Unlimited access to >100,000 searchable online datapoints per country, covering 200 countries and >800 mobile operators (total 20+ million datapoints).

- Actual data 2017-2025 and forecast data 2026-2030.

- Analyst reports providing insight on data forecasts plus additional reporting on: Fraud risk by market / A2P SMS termination rates / exclusivity agreement tracker / SMS regulatory updates.

- Quarterly A2P SMS Healthcheck.

- AI search query functionality on password protected data portal.

-

10 x user licences for your team

-

Access to Quarterly Analyst Briefing.

-

‘Ask Our Analysts’ 1-2-1 briefing session to customise your strategy.

The 12-month subscription also includes the SMS Healthcheck.

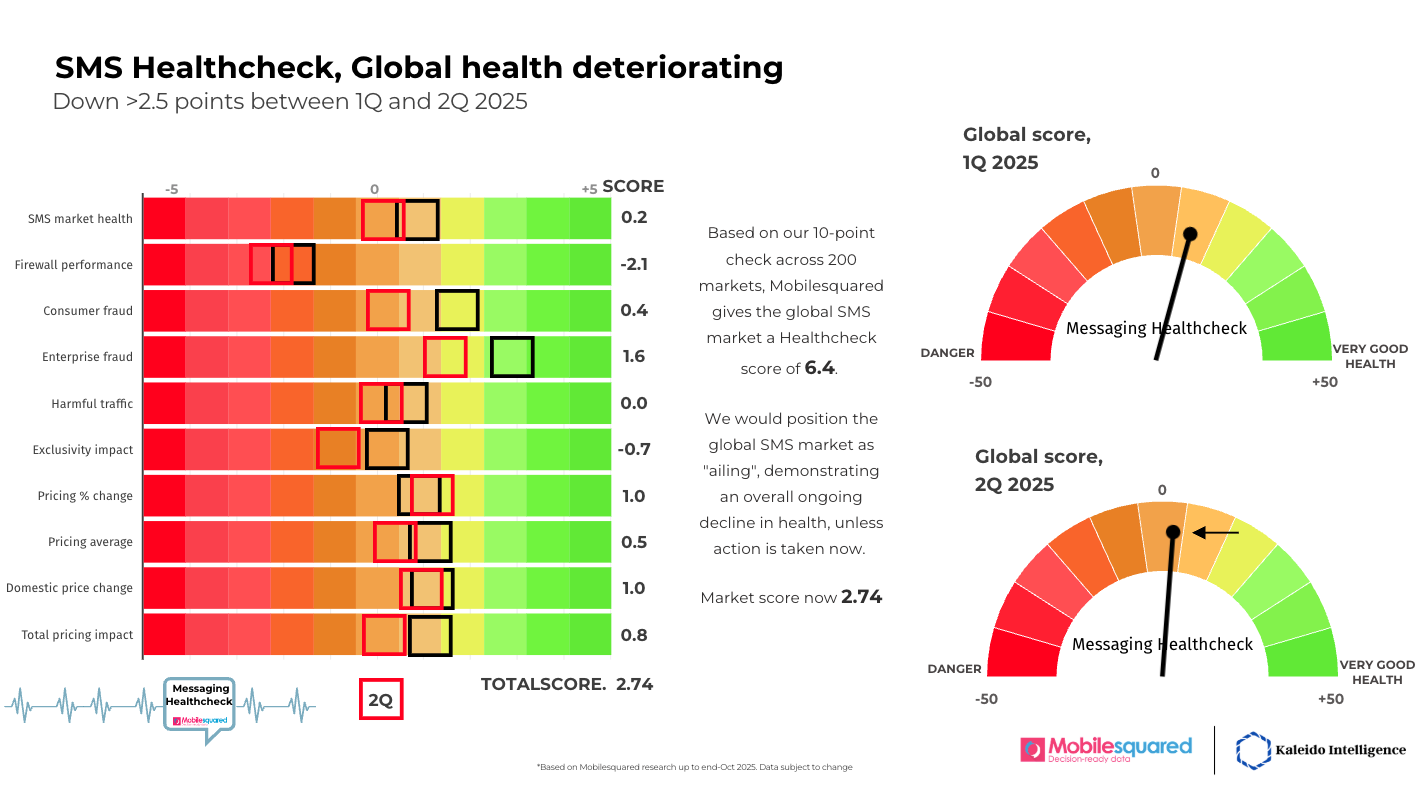

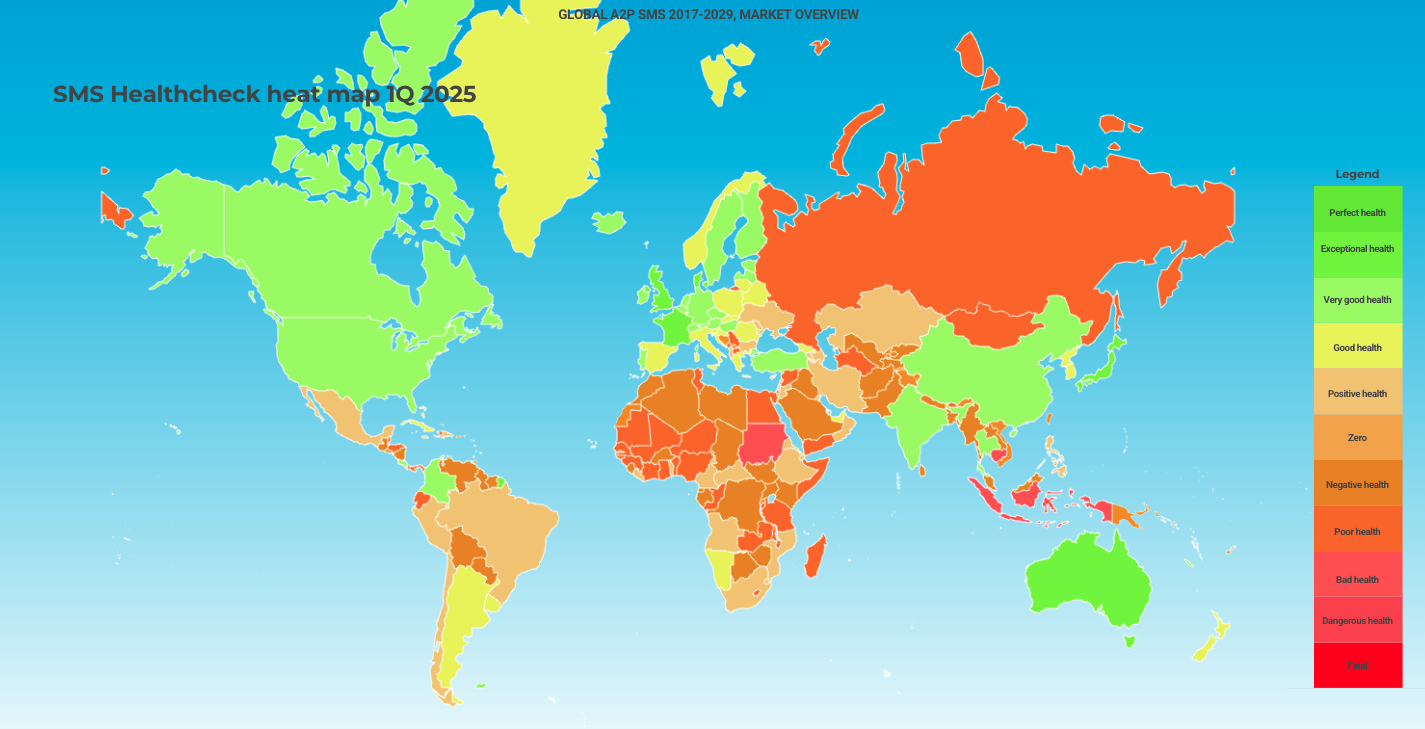

The Healthcheck is based on a 10-step process based on our industry-leading market data to assess the health of the A2P SMS market, based on data from our MessageverseTM, our online data portal containing over 70 million datapoints on all-things business messaging.

As specialists in business messaging, we look at the overall health of the A2P SMS market, the amount of fraud-free vs fraudulent traffic (from a mobile operator, enterprise and consumer perspective). In addition, we also consider additional factors that determine the overall health SMS messaging strategy, such as where an exclusivity agreement is being abused based on excessively high termination rates.

- Access to all Mobilesquared’s SMS historical and forecast data (15 million online data points / 75,000 datapoints per market), filter and download data on-demand

- 4 x quarterly market reports with latest SMS market analysis

- Country-level data for 200 markets, including total traffic/spend, fraud traffic/spend, breakdown by sector and use case, lost traffic and much more

- Data split out by 800+ mobile operators and MVNOs

- Forecasts to 2030

- Our unique SMS Healthcheck index, revealing at-risk fraud markets

- Latest A2P SMS termination rates & market analysis

- Exclusivity Agreement tracker

- Regulatory updates

- 10 x user licences for your team

Data includes:

Historical data 2017 – 2025, plus forecasts 2026 – 2030.

Traffic splits:

• Total traffic / domestic traffic / international traffic

• White route traffic / grey route traffic

• Fraud traffic: AIT traffic / Smishing traffic / SIM farm traffic / other fraud traffic

• Traffic split by use case (authentication, marketing, services, utility)

• Use case traffic split by sector: Automotive / Broadcasters / Charity / Education / Enterprise software / Finance / Gambling / Healthcare / Internet streaming / Leisure & entertainment / Public services / Restaurants & fast-food / Retail & eCommerce / Social media & chat / Telecoms / Transport & logistics / Travel & tourism / Utilities / Other

• Lost traffic to: flash calling, RCS business messaging, WhatsApp (API & APP), mobile identity, all other channels)

• Harmless traffic / harmful traffic, total actual traffic / total lost traffic

• All key traffic types split out by 800+ mobile operators and MVNOs

• AI insights on all A2P SMS data.

Spend

Our spend data is based on our traffic data, and follows the same splits as above. To achieve spend figures for each market, we apply the relevant A2P SMS domestic and international termination rates per market with aggregator mark-ups based on our ongoing market research. We also split out spend by value chain, by mobile operators and aggregators. We further split our spend by Annual Spend by Country, MNO, Source, Route, including wholesale, premium and direct.

Additional data

To provide you with the total mobile view, additional data includes:

SMS user data per market split by: total unique mobile users (UMUs) / total mobile subscriptions / opt-in users by market vertical / total users split out by device type: smartphone by OS/non-smartphone, businesses using SMS.

Markets covered: Top 200 global markets individually, including top 30 markets by spend; Afghanistan / Argentina / Australia / Bangladesh / Brazil / Canada / China / Egypt / Ethiopia / France / Germany / India / Indonesia / Italy / Mexico / Netherlands / Nigeria / Pakistan / Philippines / Russia / Saudi Arabia / Spain / Sri Lanka / Taiwan / Uganda / Ukraine / United Kingdom / USA / Uzbekistan / Vietnam

Traffic and spend terms and descriptions

Please note, where a breakdown of the spend calculation is not reference it will be based on traffic x relevant messaging rate. Where spend is broken out by mobile operator and aggregator, the share is based on the latest research, with “aggregators” used as an umbrella term to include all non-mobile companies operating within the SMS ecosystem.

Total traffic: includes all traffic, i.e. all official white traffic and all fraudulent traffic (including AIT).

Total domestic traffic: includes all domestic traffic, i.e. all official white traffic and all fraudulent traffic (including AIT).

Total domestic no AIT traffic: includes all domestic traffic, i.e. all official white traffic and all fraudulent traffic (with AIT removed).

Total international traffic: includes all international traffic, i.e. all official white traffic and all fraudulent traffic (including AIT).

Total international no AIT traffic: includes all international traffic, i.e. all official white traffic and all fraudulent traffic (with AIT removed).

Total domestic grey traffic: calculated by subtracting total domestic grey smishing, total domestic grey SIM farms, and domestic grey fraud other from total domestic grey.

Total international white fraud free traffic: calculated by subtracting total international AIT and total white international smishing from total international white traffic.

Total white fraud free traffic: calculated by adding total international white traffic with total domestic white traffic.

Total harmless traffic: calculated by adding domestic white clean + total international fraud free + domestic grey harmless + total grey international harmless.

Total harmful traffic: calculated by adding total domestic AIT + total domestic white smishing + total domestic grey smishing + total domestic grey SIM farms + domestic grey fraud other + total international AIT + total white international smishing + total grey international SIM farms + total grey international smishing + total grey international fraud other.

Total AIT traffic: calculated by adding domestic AIT + international AIT.

Total SIM farm traffic: calculated by adding domestic grey SIM farms + international SIM farms.

Total smishing traffic: calculated by adding domestic white smishing + domestic grey smishing + international white smishing + international grey smishing.

Total other fraud: calculated by adding domestic grey fraud other + international grey fraud other.

Total harmless grey: calculated by adding total grey international harmless + domestic grey harmless.

Total white fraud free traffic: calculated by adding total international white fraud free + total domestic white clean.

SPEND

Total spend: calculated by adding total white spend + total grey spend.

Total white spend: calculated by adding total mobile operator spend + total aggregator white spend.

Total grey spend: calculated by adding total aggregator domestic grey spend + total aggregator international grey spend.

Total domestic spend: calculated by adding total mobile operator domestic total spend + total aggregator domestic grey spend + total aggregator domestic discount spend + total aggregator domestic premium spend.

Total international white spend: calculated by adding total international white spend + total international grey spend.

Total domestic white spend: calculated by adding total mobile operator domestic total spend + total aggregator domestic premium.

Total domestic white AIT spend: calculated by applying domestic white AIT traffic to average domestic white route rates per market.

Total domestic white smishing spend: calculated by applying domestic white smishing traffic to average domestic white route rates per market.

Total domestic grey smishing spend: calculated by applying domestic grey smishing traffic to average domestic grey route rates per market.

Total domestic grey SIM farm spend: calculated by applying domestic grey SIM farm traffic to average domestic grey route rates per market.

Total domestic grey fraud other spend: calculated by applying domestic grey fraud other traffic to average domestic grey route rates per market.

Total domestic grey harmless spend: calculated by applying domestic grey harmless traffic to average domestic grey route rates per market.

Total domestic white fraud free spend: calculated by applying domestic white clean traffic to average domestic white route rates per market.

Total international white spend: calculated by adding total mobile operator international total spend + total aggregator international white spend.

Total international spend minus AIT: calculated by applying total international white spend + total international grey spend, minus total international AIT spend.

Total international AIT spend: calculated by applying total international AIT traffic to average international white route rates per market.

Total white international smishing spend: calculated by applying total white international traffic to average international white route rates per market.

Total international white fraud free spend: calculated by applying total international white fraud free traffic to average international white route rates per market.

Total international grey SIM farm spend: calculated by applying international grey SIM farm traffic to average international grey route rates per market.

Total international clean spend: calculated by subtracting total international spend – total international grey spend – total international AIT – total white international smishing spend.

Total white fraud free spend: calculated by adding total domestic white fraud free spend + total white international fraud free spend.

Total international grey smishing spend: calculated by applying total grey international smishing traffic to average international grey route rates per market.

Total international grey fraud other spend: calculated by applying total international grey fraud other traffic to average international grey route rates per market.

Total international grey harmless spend: calculated by applying total international grey harmless traffic to average international grey route rates per market.

Total AIT spend: calculated by adding total international AIT spend + total domestic white AIT spend.

Total smishing spend: calculated by adding total domestic white smishing spend + total international white smishing spend + domestic grey smishing spend + total international grey smishing spend

Total SIM farm spend: calculated by adding total domestic grey SIM farm spend + total international grey SIM farm spend.

Total harmless traffic spend: calculated by adding total domestic white fraud free spend + total domestic grey harmless spend + total international white fraud free spend + total international grey fraud free spend.

Total harmful traffic spend: calculated by adding total domestic white AIT spend + total domestic white smishing + total domestic grey smishing spend + total domestic grey SIM farm spend+ total domestic grey fraud other spend + total international AIT spend + total white international smishing spend + total grey international SIM farms spend + total grey international smishing spend + total grey international fraud other spend.

Total mobile operator spend: calculated by adding total mobile operator direct spend + total mobile operator wholesale spend.

Total mobile operator direct spend: calculated by adding total mobile operator domestic direct spend + total mobile operator international direct spend.

Total mobile operator wholesale spend: calculated by adding total mobile operator domestic wholesale spend + total mobile operator international wholesale spend.

Total mobile operator domestic spend: calculated by adding total mobile operator domestic white spend + total mobile operator domestic spend.

Total mobile operator domestic direct spend: calculated by adding total mobile operator domestic white spend + total mobile operator domestic spend.

Total mobile operator domestic wholesale spend: calculated by adding total mobile operator domestic white spend + total mobile operator domestic spend.

Total aggregator spend: calculated by adding total aggregator domestic discount spend + total aggregator international discount spend + total aggregator domestic premium + total aggregator international premium + total aggregator domestic grey + total aggregator international grey.

Total aggregator domestic white spend: calculated by adding total aggregator domestic discount spend + total aggregator domestic premium spend.

Total aggregator domestic spend: calculated by adding total aggregator domestic discount spend + total aggregator domestic premium spend + total aggregator domestic grey spend.

Total aggregator international spend: calculated by adding total aggregator international grey spend + total aggregator international white spend.

Total aggregator international white spend: calculated by adding total aggregator international discount spend + total aggregator international premium spend.

Total aggregator grey spend: calculated by adding total aggregator domestic grey spend + total aggregator international grey spend.

Total aggregator discount spend: calculated by adding total aggregator domestic discount spend + total aggregator international discount spend.

Total aggregator premium spend: calculated by adding total aggregator domestic premium spend + total aggregator international premium spend.

Total aggregator white spend: calculated by adding total aggregator premium spend + total aggregator discount spend.

Lost other channels spend: calculated by multiplying lost other channels traffic by the average market SMS rate.

Lost WhatsApp API spend: calculated by multiplying lost WhatsApp API traffic by the average market SMS rate.

Lost WhatsApp App spend: calculated by multiplying lost WhatsApp App traffic by the average market SMS rate.

Lost RCS spend: calculated by multiplying lost RCS traffic by the average market SMS rate.

Lost flash calling spend: calculated by multiplying lost flash calling traffic by the average market SMS rate.

Lost mobile identity spend: calculated by multiplying lost mobile identity traffic by the average market SMS rate.

Total lost spend: calculated by adding lost other channels spend + lost WhatsApp API spend+ lost WhatsApp App spend + lost RCS spend + lost flash calling spend + lost mobile identity spend

Total actual + lost spend: calculated by adding total lost spend + total [A2P SMS] spend.

Use case domestic spend: calculated by multiplying relevant use case traffic by average market domestic SMS rate.

Use case international spend: calculated by multiplying relevant use case traffic by average market international SMS rate.

Use case by sector domestic spend: calculated by splitting use case traffic by sector breakdown and multiplying by average market domestic SMS rate.

Use case by sector international spend: calculated by splitting use case traffic by sector breakdown and multiplying by average market international SMS rate.

Additional reports will cover Flash Calling, use case analysis, reports by sector.

Companies researched: In 2024/25, when updating our messaging data we received data and insight from >320 companies, including: 160 mobile operators and 150 aggregators, CSPs, vendors, hub providers, interconnect providers, regulators, firewall providers, and independent consultants. Companies that have helped our research, include:

A1 Slovenija / A1 Telekom Austria / 2Mobile / Adaptive Mobile / Aegis Mobile / Afghan Wireless / AI Cross / Alchemy / Anam / Andorra Telecom / Apprentice Valley / Arelion / AT&T / Bandwidth / Beep / Bell Mobility / Bharti AirTel / BH Telecom / BICS / Bouygues Telecom / BT/EE / Bulk SMS / Cequens / Cheetah Mobile / China Mobile International / China Telecom Global / Cisco / Claro Dominicana / Comcom / Commify / Comviva / de / Deutsche Telekom / Direqt / Enabld / Eir / Ethio Group / Ethio Telecom / Etisalat / Fonix Mobile / Global Point / GMS / Go4Mobility / Google / GTC / GTS / Gupshup / Haud / Hrvatski Telekom / Hutchison Drei Austria / Hutchison Group / iBasis / iConectiv / Infobip / Interop Technologies / iTouch Messaging / Kaleyra / Karix / Lanck Telecom / Libyana / LINK Mobility / LivePerson / m360 / Mavenir / MEF / MegaFon / Melita / MessageBird / Messagio / Meta / Millicom / Mitto / MMDSmart / MobiFone Telecommunication Corp. / Mobileum / Mobivity / Modica Group / Monty Mobile / Movitext / MTN / MTN Global Connect / MTN Irancell / MTN Nigeria / Neustar / Nova Iceland / Nuevatel PCS de Bolivia / O2 / Oi / OmanTel / Ooredoo / Openmind / Orange / Out There Media / Oxygen8 / Panacea Mobile / PCCW Global / Phronesis / PolkomTel / Quiubas Mobile / RD Com / RealNetworks / Reliance Communication / Route Mobile / Salesforce / Samsung / SFR / Sinch / SMS Highway / Softbank / Somos / Soprano / STC / Summit Tech / Sunrise / Swisscom / Synchronoss / Syniverse / Tatango / Tanla / Tata / Telecom Italia / Telefonica Group / Telefónica Móviles España / Telekom Slovenije / Telenor / Telesign / Telia / Telia Carrier / Telnyx / TelQ Telecom / Thales / Three / Three Ireland / TikTok / TI Sparkle / T-Mobile / T-Mobile US / Tomia Global / True Corporation / Tunisie Telecom / Turk Telekom International / Twilio / TWW / Tyntec / Uganda Telecom / Unifonic / Unitel / UnoTelos / US Cellular / Verizon / Viber / Vietnam posts and telecommunications group / VimpelCom / Vodafone / Vonage / Vovitel Communications / Vox / Wavecrest / Wavy / WhatsApp / WIND / WMC Global / XConnect / Zain / Zain Kuwait

- Mobile operators tracked increased from 650 to 800+.

- SMS traffic lost to alternative channels split out by; RCS for Business, WhatsApp Business (API & App), flash calling, mobile identity, and other channels.

A2P SMS forecast methodology

Our data is based on extensive research over an on-going period, starting back in 2010, and has continued ever since. With our move to quarterly tracking of the A2P SMS industry, our research is ongoing. Over any given 12-month period Mobilesquared will typically receive data and insight from over 300 companies, based on interviews, online surveys, conversations, industry events, presentations, consumer research, as well as data sharing with clients and non-clients.

The Research process

Online surveys

Mobilesquared developed online surveys for each business messaging channel, running continuously via the company website. For A2P SMS, we have developed two online surveys, one for mobile operators monetising A2P SMS traffic, and a separate survey for the broader A2P SMS messaging ecosystem. In both surveys, companies not monetising A2P SMS traffic, or have no intention of monetising A2P SMS traffic, are screened out.

1-2-1 and 1-2-many interviews

Mobilesquared uses its extensive reach throughout the messaging ecosystem to interview companies operating within, or whom have knowledge and insight of, the A2P SMS landscape. We also connect with clients and non-clients at industry events including ITW, Capacity, WAS, and MEF member events.

Data sharing

Mobilesquared shares existing data with clients and non-clients. We have over 70 A2P SMS clients and the majority provide feedback, data, trends, growth and insight on our (at the time) existing A2P SMS data and projected growth, based on their view of the industry. For clients we shared key data points from the previous 12 months in order to receive their latest market data, and expectations for the coming period. For non-clients we share older data points and request their market data up to the given period, and their expectations for the coming period.

Where requested, Mobilesquared has entered into NDAs with companies as part of a data exchange.

All data and insight is then processed, anonymised and aggregated (where there is input from multiple sources), modelled and sense-checked.

Consumer research

Our industry research is supplemented by consumer research, updated on an ad hoc basis, with the most recent research conducted in 4Q2024. This data will feed into the A2P SMS engagement data to be included in the 2025 updates. To date, the consumer research has been based on 15,000+ participants across 10 markets (Australia, Brazil, Colombia, France, Germany, Malaysia, Mexico, Singapore, UK, and USA). Consumer research forms the basis of our opt-in user data, sector data, and engagement data. Mobilesquared has supplemented consumer research with actual market data from partners to cover additional markets. Where we do not have national specific data we have applied a regionalised average per market.

Mobilesquared updates its business messaging forecasts on a quarterly basis.

Company breakdown

The breakdown of companies we engage with include 150+ mobile operators and mobile operator groups, and 150+ messaging ecosystem companies, including aggregators, CSPs, solutions providers, firewall providers, independent consultants and regulators). A list of companies can be found on our website, or provide upon request.

A2P SMS forecast methodology

The data in our global A2P SMS messaging forecasts is based on data modelling (traffic and termination rates), whereby Mobilesquared takes an average where two or more sources of actual market data were available. Across the 200 markets tracked by Mobilesquared, forecasts for each market are based on an average of 20 data points.

Due to the level of granularity in the data provided to Mobilesquared by industry, we have been able to model each of the 200 markets individually for market size, split by international and domestic traffic, which is then further split out by clean/fraud-free traffic (white routes) and fraudulent traffic (grey routes, smishing, AIT and so on).

Market growth and forecasts up to 2029-30 are based on industry insight, growth traffic, spend and trends analysed between 2017 to 2024, and the application of Mobilesquared’s market expertise.

Based on this solid foundation, the quarterly updates are based on traffic data provided by industry on the previous quarter (or quarters).

The starting point for these A2P SMS messaging forecasts is our mobile operator subscriptions database. We research the top 200 markets worldwide collating information from regulators, mobile operators and mobile operator groups. Data-only contracts and M2M accounts have been excluded (where available). Subscription forecasts are modelled based on previous growth records, overall mobile penetration rates and expected population growth.

Average A2P SMS pricing and pricing forecasts for the 200 markets covered (termination and wholesale rates) are based on mobile operator rate cards obtained on a quarterly basis from industry sources, including mobile operators, mobile operator groups, aggregators, CPaaS players, and industry consultancies.

Traffic and traffic growth forecasts for the 200 markets covered are based on our ongoing research (outlined above), looking at total volumes of authorised and unauthorised traffic, and the number of messages received per subscriber per month. The level of unauthorised traffic has also been applied according to our research into the per mobile operator deployment of SMS firewalls and SS7 protection, because of Information provided from firewall vendors and solutions providers on the rollout and adoption of SMS firewalls.

This has been further segmented from 2023 research (and historic research between 2017-2021) to breakout the new traffic types (subsets of white traffic and grey traffic) based on differing fraud types: AIT, smishing, SIM farms, and other fraud types.

Mobilesquared has made the assumption that approximately 5% of each operator’s A2P traffic will always be grey-route due to the nature of companies looking to expose and exploit loopholes, and approximately 10% will always be white-route due to direct agreements between mobile operators and the enterprise.

We have assumed that where no SMS firewall is in place that at least 80% of traffic is grey. We have also assumed there will be varying rates of protection where SMS firewalls are in place due to differences in managed solutions, hosted solutions, on-premise solutions, or blended solutions. Mobilesquared research reveals SMS firewalls typically block 80% of all traffic, and this has been applied as the basis when modelling fraudulent traffic.

We have assumed that no exclusivity agreements of preferred partner deals are in place per mobile operator, unless Mobilesquared has received data from industry through the research process of such a deal. At the time of publishing the 2025 update, over 200 known deals were in place, and these have been taken into account when looking at pricing, and the varying types of traffic activity that can associated with such deals.

Domestic and international traffic volumes, messages by sector and associated forecasts are based on our ongoing interviews, discussions and research (including detailed survey information conducted throughout 2021, 2022, up to 2025). Sector traffic, and sector traffic split out by use case, has previously only been attributed to white route messaging, but from 2025 is now applied to total domestic and international traffic, and retrospectively applied back to 2017 using historic data.

Pricing data for each mobile operator was received from multiple sources – both discount and premium messaging providers, as well as mobile operators and operating groups.

Pricing

The basis for all international spend are the latest international termination rates (as of 1Q2025) for every mobile operator. Where we have received the latest domestic rates, these have been applied. Consequently, we have used three separate rate cards for our pricing:

- A discount international rate for large-volume providers – with an approximate 10-20% mark-up on the cost of purchase from mobile operators in 2025 (we applied an average 15% mark-up).

- A premium international rate – with an approximate 30-40% mark-up on the cost of purchase from mobile operators in 2025 (we applied an average 35% mark-up).

- A domestic rate (where available) – typically 20-33% of the relevant international rate for discount or premium providers with the same mark-up applied.

- We have assumed approximately 90% of non-direct traffic between mobile operators and brands is discounted, and the remaining 10% is premium.

- We have also assumed that 5-15% of all traffic delivered to a mobile operator will be the result of a direct relationship with brands, priced without the above mark-up.

- Large mobile operating groups, and mobile operators in mature markets, are likely to see more direct traffic than smaller, independent mobile operators, in developing markets.

- Input on the cost of grey route traffic varied from 15-70% of the discount rate. We have applied a rate of 46%.

- All monetary values show the actual income for each part of the value chain – mobile operator or aggregator. Total spend is what a brand pays for messaging with the income from that then split (where appropriate) between mobile operator and aggregator.

- Mobile operator white route revenues are calculated based on varying small degrees of direct spend, according to our ongoing interviews, discussions and research (including detailed survey information conducted in the summer of 2024). The majority of mobile operator revenue is based on the average wholesale rates paid by aggregators.

- Aggregator white route revenues are calculated based on the difference between the average termination and wholesale rate per market. Mobilesquared has allocated aggregators 100% of grey route revenues, even though a proportion could be attributed to mobile operators from, for example, the sale of SIM cards used in SIM farms. SIM farm traffic has been included and split out from grey route traffic.

Artificially Inflated Traffic

Artificially Inflated Traffic (AIT) has been modelled using a spend-down approach, and these have been calculated on a country and mobile operator basis. Please note, only the country data will be released by Mobilesquared for the foreseeable future because of the sensitive nature of the traffic. In 2025, Mobilesquared revised the methodology for AIT based on market data and insight to base AIT spend per market on both domestic and international traffic, and has been calculated on the following:

Mobilesquared’s initial AIT forecasts were based on the understanding of the traffic split/messaging spend by the top 30 senders of international traffic;

the trusted assumption that these top 30 companies account for 80% of total traffic;

spend data from Twitter, and other OTT providers, based on insight shared with Mobilesquared.

Market-by-market data shared by industry.

From 2025 this has been applied across the entire market and not just the Hyperscalers.

Analysis of historic research reveals AIT has always been present but held a minimal subterranean presence in terms of threat level.

To generate the forecasts, based on research, Mobilesquared has applied AIT to every market with vastly differing degrees of activity. We have assumed that where the international termination rate is low, AIT activity is extremely restricted but is present nonetheless based on ad hoc attacks. Where the international termination rate is high, we have applied high levels of AIT activity based on an ongoing basis, and particularly where there is an exclusivity agreement in place with an international termination rate in excess of $0.10 per message.

Traffic volumes were derived from dividing the total spend per market by the international termination rate cost per mobile operator, or the average international termination cost per market. Please note, the methodology to generate AIT forecasts is focused on spend, with traffic levels an output of this spend total. Mobilesquared acknowledges that this approach does not take into account the discounts negotiated by the major brands sending bulk messages globally. Because Mobilesquared believes the spend figure is an accurate reflection of AIT spend throughout the forecast period, Mobilesquared clients could apply known discounted international termination rates to get (what could) be a more accurate reflection of traffic levels on a market-by-market basis.

Please note, AIT has a permanent presence throughout the traffic section of this report, and is clearly stated where it has been removed. However, due to the uncertainty and inconsistency in the data shared by industry relating to where brand spend in AIT is (and should be) allocated in the value chain, Mobilesquared has only applied AIT to total spend on a market level basis, and its inclusion within the A2P SMS datasets and report has been restricted to market spend data associated with fraud, such as the “Harmful” view of the industry. Where AIT has been removed from the spend forecasts, it has been clearly labelled as such.

Lost traffic/spend

This is based on Mobilesquared’s Alternative View of the A2P SMS marketplace. This is based on extending the market trends and growth between 2017 to 2021 up to the end of our forecast period (2029), and excludes the impact of the high international termination rates and direct drop in traffic that has massively impeded the actual A2P SMS industry. From 2H 2021, international termination rates started increasing astronomically and this has skewed the market between 2021-2025, to create an artificial high in terms of market spend on A2P SMS.

The Alternative View applies the growth experienced between 2017 to 2021 over our latest forecast period, and generates spend based on the termination rates up to 2021 with increases over the forecast period based on market inflationary levels.

The delta between total alternative view traffic and actual total A2P SMS traffic determines our lost traffic figure. We then apply the market research to split the lost traffic between the various channels and solutions available to brands to communicate with consumers.

What Our Clients Say…

“Mobilesquared delivers valuable insights and data and is an important contributor to the success of our global market intelligence service”

Joanna Kuligowska, Head of Global Market Intelligence, Haud

“Mobilesquared offers a depth and breadth of data and forecasts on the mobile messaging marketplace that is unrivalled. Their data is now used broadly within Sinch.”

Robert Gerstmann, Chief evangelist & Co-founder, Sinch

“Mobilesquared’s insight into the CPaaS space, and your close links to the key players in it, really helps us to have good information about what is going on in these markets and how to respond.”

Tim Ward, Sales & Marketing VP, XConnect

A2P Articles

How to create a sustainable business messaging market

Nick Lane2025-07-17T10:55:37+00:00July 17th, 2025|A2P, Business Messaging, Uncategorized|

Mobilesquared x GTC: The future of business messaging in the telco advisory space with ‘Messaging Pulse’

Jo Hall2025-05-30T15:39:05+00:00June 14th, 2024|A2P, Business Messaging, Whitepapers & Reports|

Mobilesquared and GTC partner to provide messaging insights and consultancy in one

Jo Hall2025-04-17T19:03:17+00:00May 9th, 2024|A2P, Business Messaging|

FAQs

We conduct in-depth business messaging market research, interviewing around 300 companies annually across the messaging ecosystem. We also run surveys on key topics and collaborate with mobile operators who share anonymised mobile insight data.

Our work with key trade bodies and industry forums keeps us ahead of developments. Combining diverse source insights with annual findings over the last ten years has led to the Messageverse—a data universe of over 70 million data points that our customers can access freely.

Our research spans 200 countries worldwide, providing forecast and actual data for each country.

We publish market analyst and data reports on A2P SMS, WhatsApp, CPaaS, RCS/RBM, and data soley for Facebook and Viber. Our messaging market reports cover topics like AIT, OTP, and A2P SMS fraud. View examples of our reports here.

Access our research through an annual subscription for in-depth intelligence by channel, as a snapshot country-specific data report, or as bespoke intelligence, like whitepapers or workshops.